Copy Link

The 2:1 Rule: Why Your Gym Needs Double the Cash You Think It Does

If it costs you $40,000 a month to keep your business open, how much cash should you have in reserves?

Most gym owners answer somewhere between "none" and "maybe one month's worth if things are good." But the benchmark answer that separates surviving businesses from thriving ones is $80,000.

That's the 2:1 liquidity ratio. And it's the financial safety net most gym owners don't have but desperately need.

What Is a Liquidity Ratio?

A liquidity ratio measures how easily a company can pay off its short-term debt with available cash and assets. In simple terms, it's making sure you have enough money to cover yourself for a certain amount of time.

Think about personal finance. The old adage says you should have six months of income saved, or at least enough to cover six months of living expenses. Your business needs the same kind of cushion.

The standard benchmark is 2:1. For every dollar you need to operate each month, you should have two dollars in cash reserves. If your monthly operating costs are $40,000, you should theoretically have $80,000 sitting in reserve.

We can't foresee a pandemic around the corner. Many of you lived through that reality. You know what it's like when revenue drops to zero overnight but expenses keep coming. That 2:1 ratio is your buffer against the unexpected.

The Tax Strategy Balance

Now, before you start frantically building up a massive cash reserve, understand there are tax implications to consider.

If you're keeping all this money in your business bank account, you're going to pay taxes on it. If you push your ratio up to 6:1 or 7:1, meaning you have $300,000 or $400,000 sitting in an account earning 0.1% interest, you've had to pay significant taxes to accumulate that money. And now it's just sitting there doing nothing.

That's not good business sense either.

In many cases, you're better off reinvesting in the business itself or using tax strategies to optimize how much you keep liquid versus how much you deploy. Maybe that means buying your next Anytime Fitness location. Maybe it means investing in equipment or technology that drives revenue. Maybe it means working with a financial advisor to structure your reserves more efficiently.

The point isn't to hoard cash. The point is to have enough liquidity to weather a storm without panicking, while also being smart about where your money works hardest for you.

Conducting Regular Financial Health Checks

Understanding your liquidity ratio is just one piece of maintaining financial health. You need regular review routines to identify red flags and opportunities for improvement.

Here's a simple framework for what to review and when:

Monthly Reviews:

Analyze your profit and loss statements

Monitor cash flow

Review membership metrics and KPIs

If you look at everything all the time, it becomes overwhelming and you eventually stop doing it. Focus on these three critical monthly metrics.

Quarterly Reviews:

Evaluate all your expenses (line by line)

Assess your liquidity ratio (are you maintaining that 2:1 benchmark?)

Review your balance sheets

You don't necessarily need to review balance sheets every month, but quarterly gives you enough frequency to spot trends without getting lost in the weeds.

Yearly Reviews:

Strategic financial planning

Tax planning and compliance

Benchmarking against industry standards

This is where you compare your performance to the broader market. For example, if the industry average profit margin is 12% and Anytime Fitness corporate locations run flat to 3.5%, you can see where you have opportunity or where you're excelling.

The Tax Planning Timeline

Here's a critical insight most gym owners miss: you can't do tax planning on December 31st. That's way too late.

When should you start looking at tax planning for the year? January 1st of that year.

You need to be constantly looking back at the previous quarter to prepare for the quarter ahead from a profit and loss standpoint, cash flow perspective, and tax strategy angle.

Let's say you have an aggressive goal to grow 20% this year. You plan accordingly in January. But by June, you realize you're only going to hit 5% growth. Or conversely, you planned for 5% but you're crushing it because you added nutrition or recovery services.

Either way, you need to adjust your tax strategy mid-year. That might mean reinvesting more in the business. That might mean preparing to buy your next location. You can see these opportunities and adjust mid-year instead of scrambling at the end of December to buy a pickup truck you don't really need.

Smart Investing vs. Panic Buying

Speaking of buying things you don't need: be strategic about year-end spending.

Sometimes buying a gym at the end of the year makes perfect sense. If it's the right move financially and strategically, timing shouldn't stop you.

But don't buy things just to reduce your tax burden if you don't actually need them. There's a difference between strategic investment and wasteful spending.

For example, if you buy $200,000 worth of gym equipment that you know you'll use in the next year and you have free storage space, that can be a smart move. But if you're buying things just to buy things, you're making a mistake.

The Costco Principle

Here's a principle to keep in mind: if you go to a regular grocery store and buy two rolls of paper towels, you'll use those two rolls accordingly throughout the week. But if you go to Costco and buy a 24-pack, you'll use as much as double the amount of paper towels just because you think you have them.

There's an actual economic principle behind this (I wish I could remember the exact name of the law), but the point is clear: having excess doesn't always lead to efficiency. Sometimes it leads to waste.

The same applies to gym equipment sitting in a warehouse. Sure, you bought it with good intentions. But did some people take advantage of those kettlebells sitting there and use them where they weren't supposed to? Probably.

Be careful with your purchases. Make them strategic, not reactive.

Ongoing Practices for Financial Health

Beyond the regular review cycles, maintain these ongoing practices:

Regular financial forecasting - Don't just look backward. Project forward based on your current trends and planned initiatives.

Maintain a dashboard - Have key metrics visible at a glance so you're not digging through spreadsheets every time you want to know where you stand.

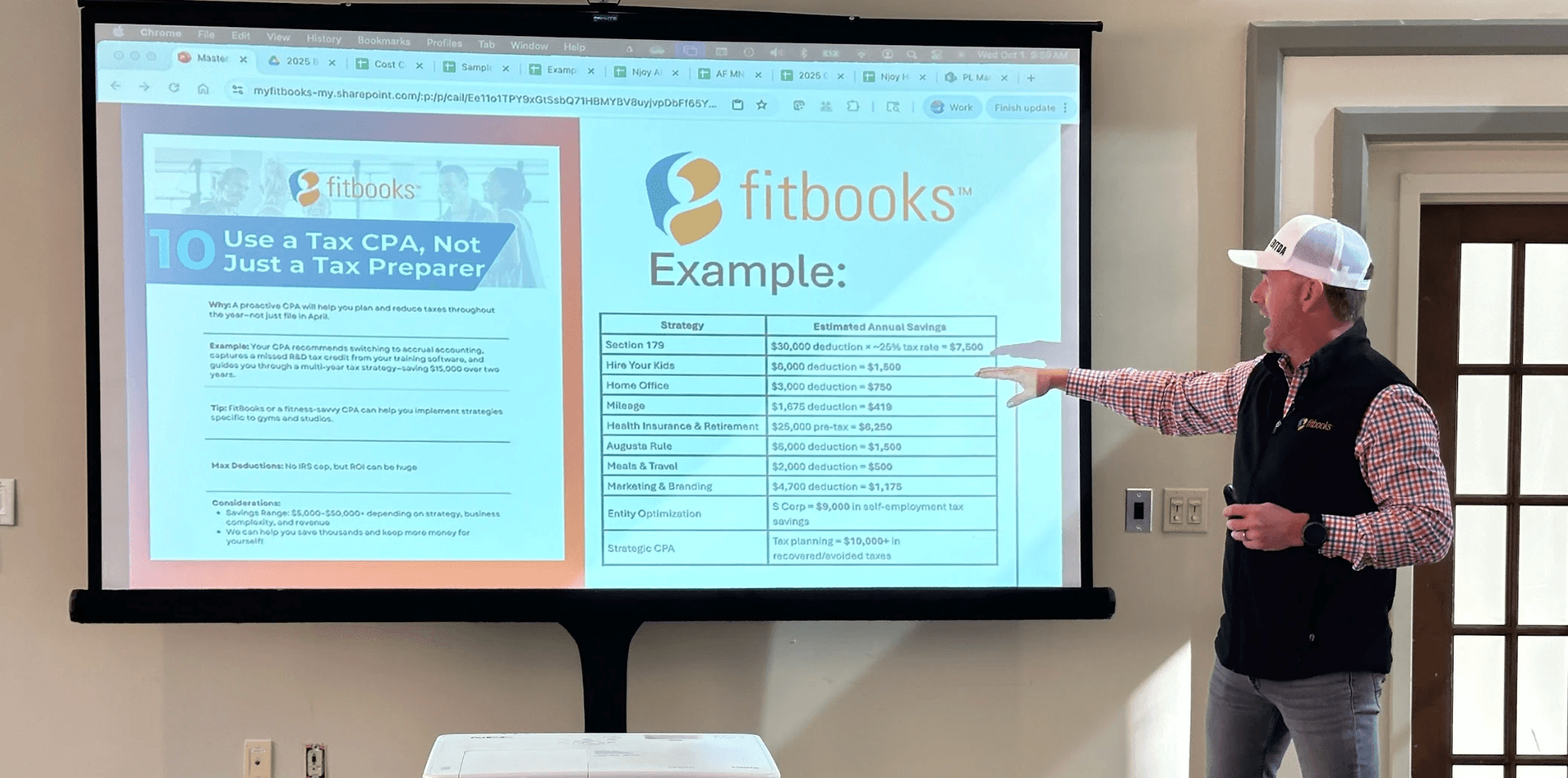

Engage with financial advisors - This is critical. Get that second piece of advice. Having an expert who understands both fitness business models and tax strategy can save you tens of thousands of dollars and help you avoid costly mistakes.

The Bottom Line

Your liquidity ratio isn't just a number on a spreadsheet. It's your business's ability to survive unexpected challenges and capitalize on unexpected opportunities.

Aim for that 2:1 benchmark. If your monthly operating costs are $40,000, work toward having $80,000 in reserves. But be smart about it. Balance liquidity with tax efficiency. Don't let cash sit idle when it could be working for you.

Review your financials monthly, quarterly, and yearly with discipline. Start tax planning on January 1st, not December 31st. Make strategic investments, not panic purchases.

And most importantly, engage with financial professionals who can help you navigate the complexity of running a profitable, sustainable fitness business.

Because at the end of the day, knowing your numbers isn't just about accounting. It's about having the financial foundation to build the business you've always envisioned without living in constant fear of what might happen next month.

Share lesson:

About Author

Ceo & Strategic Architect

Builder of 30+ fitness studios and advisor to 200+ gyms across North America. Andrew leads Mastermind with a focus on structure, culture, and execution that scales without burnout. He helps owners simplify decisions, align teams, and grow with clarity.

Be notified of new videos & blog posts as soon as they drop

You've been subscribed!